Finance Consulting Services Global Global

Transform finance to unlock sustainable growth, manage cash flow, and improve governance. Unlike accounting’s reliance on transactional data, finance looks at how effectively an organization generates and uses cash through the use of several measurements. The statement of profit or income statement represents the changes in value of a company’s accounts over a set period (most commonly one fiscal year), and may compare the changes to changes in the same accounts over the previous period. All changes are summarized on the “bottom line” as net income, often reported as “net loss” when income is less than zero. Whether you’re a CFO, an accountant, a financial analyst or a business partner, artificial intelligence (AI) can help improve your finance strategy, uplift productivity, and accelerate business outcomes.

A global consumer goods producer maps out an integrated digital future

Evaluate their qualifications, experience, specialized services, and references to find a consultant compatible with your business. These can provide valuable insights into the consultant’s reliability, competence, and professionalism. While there are many benefits to hiring an difference between fixed and flexible budget accounting consultant, businesses must also consider the costs. Strategic planning is a vital component of financial management and long-term business success.

Do you already work with a financial advisor?

Whether you have a mature GBS or are early in the journey, our assessment tools, digital technologies, and operating model design will unlock hidden value that achieves world-class operations. Stay on top of regulations with an integrated compliance function and our SOX advisory services and internal audit programs. To help elevate your business fluency, here’s a look at the differences between finance and accounting.

- Deloitte’s human capital practice can help you reshape HR practices, identify and attract the right talent, and enable your organization to have in Finance the people who can help to transform now and into the future.

- Agile, data-driven finance functions have become strategic partners to their businesses.

- M&A can serve as a catalyst for organizations, and finance in particular, to embark on a digital transformation journey.

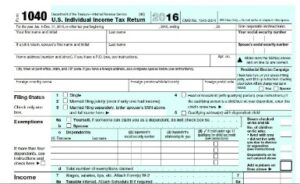

- The results often include thorough financial statements—including income statements, balance sheets, and cash flow statements—that are used to understand an organization’s position at a given time.

- Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

Global business services: The true generative AI leader

We bring together passionate problem-solvers, innovative technologies, and full-service capabilities to create opportunity with every insight. Each solution brings together the thinking, capabilities and technology from EY net cash flow teams and the EY partner ecosystem. Finance leaders should accelerate an enhanced approach to environmental, social and governance (ESG) reporting.

Master data management (MDM) for finance

KPMG helped a U.S.-based Fortune 500 medical supplies distributor establish global finance operations in the midst of acquiring an $800 million, 50-country company. It is the combination of a predominant mindset, actions (both big and small) that we all commit to every day, and the underlying processes, programs and systems supporting how work gets done. Helping clients meet their business challenges begins with an in-depth understanding of the industries in which they work. In fact, KPMG LLP was the first of the Big Four firms to organize itself along the same industry lines as clients. EY Consulting includes experienced leaders in every sector, who bring the power of people, technology and innovation together to deliver value and growth for our clients.

Efficient working capital and cash management along with improved capital allocation is integral to financial and operational health. No matter how well-run your organization is, there are likely balance sheet and operational improvement opportunities. Fast-changing global markets demand that organizations have financial stability, agility, and liquidity.

Accounting consultants use specialized knowledge to assist companies in managing financial resources, ensuring legal compliance, and making strategic decisions based on accurate financial information. We help CFOs and finance leaders boost shareholder returns, master capital markets, build superior end-to-end M&A capabilities, and more. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. In the early days of COVID-19 business impact, KPMG helped a global 100 company’s finance organization perform a virtual close for timely quarterly reporting.

They can identify potential financial risks and recommend strategies to avoid or minimize them, helping businesses avoid costly mistakes and safeguard their financial stability. Our cyber risk services help organizations create a cyber-minded culture and become stronger, faster, more innovative and more resilient in the face of persistent and ever-changing cyber adjusting entry for bad debts expense threats. Our ecosystem and experienced professionals provide insights that can help you make more informed decisions, like public vs. private; navigate issues like hybrid and ERP adoption; and migrate more efficiently. KPMG helped the company’s CFO create an efficient organization capable of providing timely, accurate and meaningful business insights. Enabled by data and technology, our services and solutions provide trust through assurance and help clients transform, grow and operate.