The trial balance, after the closing entries are completed, is now ready for the new year to begin. Think about some accounts that would be permanent accounts, like Cash and Notes Payable. While some businesses would be very happy if the balance in Notes Payable reset to zero each year, I am fairly certain they would not be happy if their cash disappeared. Get granular visibility into your accounting process to take full control all the way from transaction recording to financial reporting. Income investing is an investment strategy that focuses on generating regular income from assets such as dividend-paying stocks, bonds, and real estate investment trusts (REITs).

Related Entrepreneurship Terms

The result, either income summary definition net income or net loss, is then transferred to the owner’s equity account. Furthermore, the comparison between revenues and expenses provides investors and stakeholders with clear insights into how profitably a company is operating, which is invaluable information for making investment decisions. Thus, the Income Summary plays a crucial role in effectual financial analysis, planning, and resource allocation. In this case, the income summary account has a net credit balance which means that the company has a net income of $5 million. Closing the income summary account is done after all income sources are accounted as retained earnings of the organization.

Examples of Gross Income

A significant determining factor in the future feasibility of UBI is the matter of https://www.bookstime.com/ political support. According to a 2020 survey conducted by the Pew Research Center, a narrow majority of Americans oppose the concept of federal UBI. In 1962’s “Capitalism and Freedom”, he argued that a “negative income tax”—essentially a UBI—would help overcome a mindset where citizens aren’t inclined to make sacrifices if they don’t believe others will follow suit. “We might all of us be willing to contribute to the relief of poverty, provided everyone else did,” he wrote. To reduce income inequality, governments and private sectors must address its various causes, including discrimination, unfair taxation, wage stagnation, and more that lead to large imbalances in compensation.

What is your current financial priority?

Still, the term “cash flow” is used loosely in the industry, sometimes in reference to SDE or EBITDA, or the general profitability of a business. Gross income and net income are two terms commonly used by businesses to describe profit. Both terms can also be used to explain how much money a household is making or taking home. Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming do not collect state income taxes. The percent of your income that is taxed depends on how much you earn and your filing status.

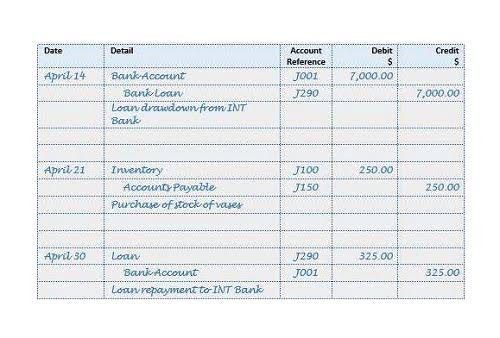

EBT, also referred to as pre-tax income, measures a company’s profitability before income taxes are accounted for. EBIT is helpful when analyzing the performance of the operations of a company without the costs of the tax expenses and capital structure impacting profit. This is the profit before any non-operating income and non-operating expenses are taken into account. After these two entries, the revenue and expense accounts have zero balances. The first is to close all of the temporary accounts in order to start with zero balances for the next year.

- If you don’t have a complicated tax situation, a tax calculator can give you an idea of how much income tax you might owe.

- It summarizes income and expenses arising from operating and non-operating activities.

- You discretionary income is the amount you have available after paying for necessary expenses, or money available to budget.

- Companies use closing entries to reset the balances of temporary accounts − accounts that show balances over a single accounting period − to zero.

- An income summary account is a temporary account used at the end of an accounting period to collect all revenue and expense account balances.

- For companies, gross income is interchangeable with gross margin or gross profit.

Due to historical precedent, independent FMRs are calculated for Columbia, MD, but income limits are not. By statute, income limits are calculated for Rockland County, NY while separate FMRs are not. HUD uses FMR areas in calculating income limits because FMRs (or 40th percentile rents for 50th percentile FMR areas) are needed for the calculation of some income limits; specifically, to determine high and low housing cost adjustments. The exception to the similarity between Fair Market Rent areas and https://www.instagram.com/bookstime_inc Income Limit areas is Rockland County, NY. Net income appears at the bottom of the income statement after all of the cost of goods sold and operating expenses have been subtracted out.